Telecom Review sat down with Samar Mittal, Head of Cloud and Network Services, Nokia MEA, to talk about his new position, the company’s role in helping CSPs unlock their network value, as well as the main business trends in the region and Nokia’s complimentary business-centric solutions.

Congratulations on your recent appointment as head of CNS, Nokia MEA. Can you tell us more about your new role in the MEA region?

Thanks for your kind wishes, I have been in the region for just about three months, and I am now even more excited than I was before taking this new role as I meet customers in the region and discuss their challenges in navigating various phases of their growth journey. Some already have a matured 5G launch and are looking towards new revenue streams through 5G SA; some are preparing for 5G while others still see 4G as their mainstream revenue driver.

There is one common theme resonating across the spectrum. Customers are looking for growth beyond connectivity, exploring new revenue verticals and business models. They are also looking at ways to enhance personalized experience while securing network. I am very excited to see that Cloud and Network strategy and portfolio fully align with customer aspirations, and we are helping them achieve success.

There is one common theme resonating across the spectrum. Customers are looking for growth beyond connectivity, exploring new revenue verticals and business models. They are also looking at ways to enhance personalized experience while securing network. I am very excited to see that Cloud and Network strategy and portfolio fully align with customer aspirations, and we are helping them achieve success.

As a global leader in telecom network technologies, Nokia has built networks for CSPs the length and breadth of the MEA region. How can they now fully unlock the value of their networks?

CSPs invest heavily in building their networks. Their investments are primarily directed towards keeping pace with technology evolution, capacity and coverage demand. However, many CSPs struggle with the value realization of their investment. From that angle, I would argue that three key pillars that require proper CSP attention to unlock the value of their network are reputation, revenue and productivity.

CSPs’ reputation pillar is all about protecting their brand, boosting their customer experience and NPS. As the complexity of the network increases and the network moves towards edge, the mission of safeguarding CSPs’ reputation requires revisiting the security and analytics domain. Recent events in the North American and European markets have exposed latent vulnerabilities; it is a topic worth attention.

Secondly, from a revenue perspective, CSPs are facing challenges with the connectivity business. The connectivity market is at a stall, with less than 6% yearly growth, while the digital ecosystem market is growing at 30% to 40% per year. CSPs must figure out how to participate beyond just connectivity and build capability for the network to be part of a service chain to tap into digital ecosystem opportunity. This requires a new business model. CSPs are revisiting this domain to involve developers in driving consumption of the network as code via hyperscale ecosystems, and API’s would be the new currency!

And finally, productivity through automation – maximizing human capital. As CSPs align their strategies to become part of the new value creation shift in the market driven by digital ecosystem and service chain revolution, they will ultimately need to consider another parallel paradigm shift on how they architect and operate their networks. CSPs underlying 4G/5G infrastructure of RAN, Transport and Core needs to be connected to their digital front-end, which faces their enterprise customers and consumer. Between these two layers lies a lot of friction, and there is a need for extreme automation to make this frictionless.

What are the main business trends that you identify in the Middle East market?

I see three major trends emerging out of the MEA:

- Convergence between the CSPs & application providers – Post Covid, the trend of zero-touch and paperless transactions has gone up multifold, and CSPs are looking for solutions to stay relevant in this space. Nokia CNS strategy of Network as a Code and API’s as a currency enables this strategy, and operators are now defining their future architecture with this being their end goal.

- Shift in connectivity value and new business model – Connectivity has become a commodity and is limiting growth potential as per industry analysts. We are seeing a generational shift with the emergence of new service chains based on infrastructure, networks and applications. Services are provided by a single company, paid as subscription and delivered as a software download. CSPs are starting to become part of this service chain, gaming and media being two examples.

- Emergence of solutions for new experience on major events – With the FIFA World Cup being hosted within the region, a lot of innovation will lead us into a new era to provide a different experience to customers and new monetization opportunities for event organizers. This domain will see a major value shift.

How are Nokia’s solutions helping its customers in the MEA region to fully achieve their business goals?

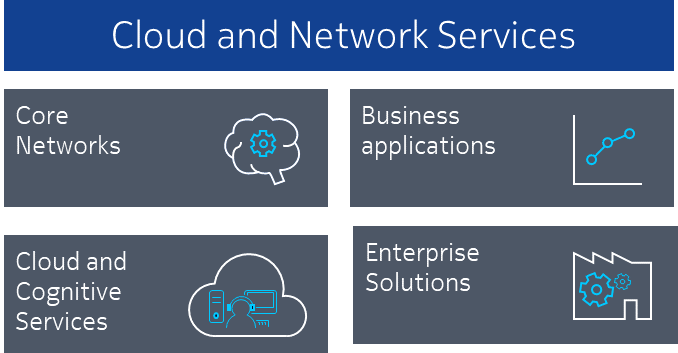

We create technology that helps the world act together. CNS helps CSPs and enterprises to navigate through the major industry transition of introduction of 5G networks and cloud-native software.

These transitions place demands on organizations to find new ways to monetize digital assets, optimize costs, navigate complexity and mitigate security risks for their mission-critical network.

Nokia’s leading core network software gives CSPs the flexibility, intelligence, and automation required to securely deliver advanced 5G services and does so without being boxed into any solution, cloud infrastructure or vendor. CSPs can deploy their network as software on any cloud – private, public or hybrid cloud.

Business application (BA) portfolio helps CSPs to automate, secure and monetize their networks using data insights. It provides broader telecom software ranging from OSS/BSS to analytics, security and device management. Its software can run on any cloud environment, with multiple SaaS use cases already available.

Business application (BA) portfolio helps CSPs to automate, secure and monetize their networks using data insights. It provides broader telecom software ranging from OSS/BSS to analytics, security and device management. Its software can run on any cloud environment, with multiple SaaS use cases already available.

Cloud and Cognitive Services (CCS) help manage complexity, technology and value creation through high-end expertise and automation in operations, including niche Managed Security Services and Multi-vendor Managed Performance Services.