In a keynote focusing on the priorities around digital infrastructure such as subsea, data center and edge expansion, and its implementation growth in the GCC region, Georges Jaber, Vice President Wholesale and Carrier Relations, Salam; Fahad Alhajeri, CEO, center3; Sohail Qadir, CEO, Zain Omantel International (ZOI); and Sam Evans, Senior Managing Director, FTI Delta (Moderator) gathered on stage.

How Ready is the Digital Infrastructure in the GCC?

Qadir is optimistic when it comes to the region’s growth and potential, and as ZOI, they are “looking at where we need investments,” with a focus on more partnerships.

As shared by Alhajeri during the discussion, “what it takes to become a digital hub is to have state-of-the-art data centers. The GCC region has shown significant growth within the last five years with its goals driven globally. With fast-paced development, the GCC is growing as the promising digital hub in this side of the world.”

Alhajeri further noted that one important aspect that is “regional IP networks,” which are currently still fragmented to some extent. This is perceived to be normal as before there was no localized content but he believes that “the market will adjust itself and the demand to make this happen.” The infrastructure is in place, and what is required is action and initiative from the regional telecommunications companies.

Regional Interconnection Needed

All speakers expressed the necessity of regional interconnectivity within the GCC. Given the advantageous location of the Arab Peninsula, the demand for data center capacity will continue to increase amidst the increased presence of hyperscalers.

This relates to the name of center3, which is derived from their strategic positioning at the nexus of connecting three continents: Asia, Africa, and Europe. “That gives a level of resiliency and we can avoid many of the geo political issues that exist today… I believe we do have all the ingredients to lead and evolve as a hub in the region,” stated Alhajeri.

Salam affirmed that the region is progressing at a very fast pace. “We have the first building block (which is the data centers) and I believe, in Saudi, we have so many initiatives happening,” pointed out Jaber. Numerous companies are constructing data centers, with hyperscalers also entering the Saudi market, not to mention the numerous initiatives surrounding submarine cable, 5G fixed wireless, and IoT, among others. Due to this, “we need to work more on regional interconnectivity.”

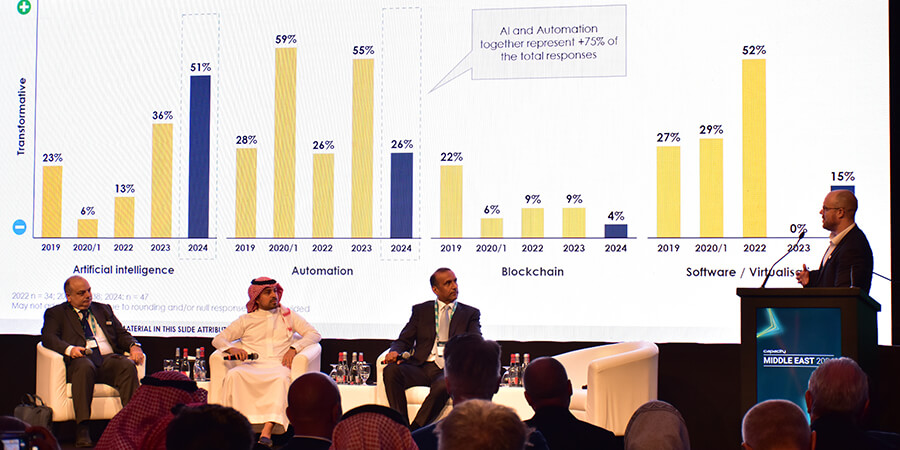

Jaber also observed that within Saudi, there are multiple internet exchanges. “Maybe we need to connect all these exchanges together so that content can be more localized.” With the increasing presence of hyperscalers and the adoption of artificial intelligence, the demand is expected to soar.

Demand for AI

“It’s gonna require massive data centers; not even the scale that we're building now. It's gonna be hundreds of gigawatts for each data center for AI,” Jaber expounded. Meeting this demand will necessitate significant investment in international fiber connectivity, which poses a formidable challenge to address over the next five years.

Qadir shares the same views, stating that “AI will be huge in the region.” As the demand grows, more data centers are being planned to accommodate it, with various governments getting involved and offering incentives to support the expansion. He also reiterated that “interconnectivity within the region” is required to deliver their visions.

Powering Data Centers

Alhajeri outlined how, as part of the strategy to establish a digital hub, they’ve been actively exploring technologies to make sure that don't use excessive amounts of power. With 11 existing subsea cable systems, and a few more rolling out in Africa, there must be a solution for subsea cable systems, technically, to switch traffic between each other. This will how they will accelerate and “be ready with the right capacity to self-organize.”

Jaber also foresees a lot of investments in renewable energy to help meet the power requirements for data centers.

Edge Locations

AI is expected to create a lot of opportunities for cloud computing, while also extending content to the edge. “We see CDNs that have come into Saudi in this setup… We believe this trend will continue as we're seeing more and more content providers coming into the region.” In line with this, there are also a lot of initiatives on the regulatory side that are helping these content owners enter the region. As this progresses, it could solve the need for more interconnection.

Importance of Partnerships

Qadir emphasized that “nobody can work alone and create something that can make an impact.” Citing Europe as an example of a hub, the Middle East can also benefit from partnerships. “We are entering into partnerships, which means that we are leveraging each other's expertise and each other's infrastructures… It's better to collect everything in one place and then move forward.”

The CEO continued that Zain Omantel International alone cannot do much, as they “need partners as a start and we need everyone to work together to become a hub in the region.” It won't be just Oman, Saudi Arabia, or the UAE standing alone; rather, it must be a connected network of data centers.

In terms of consolidations, Alhajeri aligns with his perspective that “we should complement rather than compete with each other.” Their recent acquisition of CMC Networks demonstrates their commitment to providing clients with a comprehensive, one-stop solution. “We provide hosting services and we provide international connectivity; and with our IXs to exchange data, we're adding a fourth dimension to our portfolio by providing network management.”

Similarly, Jaber communicated that on the partnership side, “we definitely need to get together and build this route.” There is no other way to connect without partnering with carriers along the way. For example, Salam is connected to around seven countries across the region, working on delivering this interregional, data-center-to-data-center connectivity.

On the other hand, ZOI has spoken about the huge geopolitical issue, that comes with a billion-dollar risk. “I think it is something that we need to work on together as an industry.”

The session concluded with a sense of optimism for partnership within the region, a notion that the region is digital infrastructure ready, and that there will be a huge influx of demand which creates significant business opportunities.