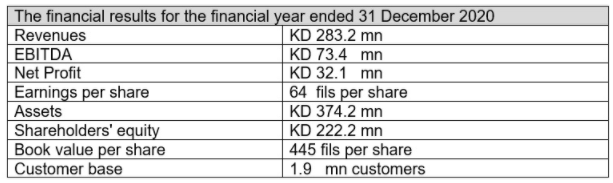

Kuwait Telecommunications Company (stc), a world-class digital leader providing innovative services and platforms to customers and enabling the digital transformation in Kuwait, announced its financial results for the financial year ended 31 December 2020.

Commenting on the announcements of these results, Dr. Mahmoud Ahmed Abdulrahman, stc’s Chairman, stated: "Company's total assets reached KD 374.2 mn at the end of 2020, while the total shareholders' equity increased by 3.2% reaching KD 222.2 mn. As a result, the book value per share reached 445 fils. Moreover, the company has a strong solvency position among its peers in the Middle East.

stc’s Board of Directors has recommended distributing cash dividends to respective shareholders of 60 fils representing 60% of the share’s nominal value for the year ended 2020, subject to the approval of the Ordinary General Assembly of the company. This decision was driven by stc's confidence in the evolution of its business, its strong financial position and the ongoing cash flow generation during economic downturns."

Commenting on the company’s financial results, Eng. Maziad bin Nasser Al Harbi, stc’s CEO, stated: "Despite the worldwide economic challenges associated with the COVID-19 pandemic and the strong competition in the Kuwaiti telecommunications market, stc has managed to achieve good levels of revenues and enhance its operational efficiency to add value to its customers and achieve better returns to its shareholders.”.

Al Harbi added, "Consequently, stc has been able to achieve good financial results that meet the aspirations of company's shareholders during the unprecedented and unstable situations where the total revenue reached KD 283.2 mn in 2020, compared to KD 293.7 mn last year. This decline is attributed to the total and partial lockdown imposed in Kuwait due to COVID-19, resulting in a decline in the sales revenues of the consumer sector, as well as a significant and almost a total decline in the roaming services revenues as a result of the closure and suspension of flights at most airports worldwide. stc’s social contributions that we are proud of have also contributed to the decline in company’s revenue, where customers have been provided with unlimited free local calls for all mobile networks, in addition to a 5GB internet package per day from March 22, 2020 to April 20, 2020, in collaboration with the Communications & Information Technology Regulatory (CITRA) in support of the Kuwaiti community during the COVID-19 crisis. In contrast, sales of the business and enterprise sector has witnessed a growth in volume due to the need and increasing demand for digital and IT services.

On the other hand, while COVID-19’s negative consequences during 2020 had a significant impact on the financial results of most of the companies, this has put a considerable pressure on the business movement, which in turn led to a decline on stc’s consolidated revenue resulting in a decline on company’s profitability levels during 2020. The increase in the expected credit losses for on trade, other receivables and contract assets was also by 17.9% reaching KD 15.0 mn in 2020 compared to 2019 had a significant impact on EBITDA which reached KD 73.4 mn in 2020 compared to KD 83.8 mn during 2019. While EBITDA margin reached 26% in 2020 compared to 29% in the previous year. On the other hand, the increase in the depreciation and amortization item by 4.2% to reach KD 39.3 mn in 2020 as a result of capital expenditures invested on expanding the 5G network formed a burden on company's net profit which reached KD 32.1 mn (earnings per share 64 Fils) with a profit margin of 11% compared to KD 43.6 million (earnings per share 87 fils) and a profit margin of 15% recorded by the company in 2019. While the customer base has reached KD 1.9 mn customers by the end of December 2020”.

Al Harbi added: "stc's financial results for the end of 2020 reflected its competitiveness and strengthened its position as the second largest telecommunications company in terms of its market share of revenues in the Kuwaiti telecommunications sector of approx. 35%".