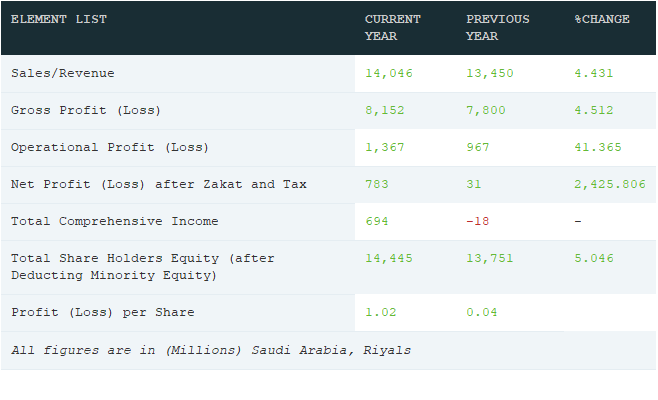

Etihad Etisalat (Mobily) achieved a net profit of SAR 783 million for the year ended 31 December 2020, compared to a net profit of SAR 31 million in 2019.

The company’s revenues in 2020 amounted to SAR 14,046 million versus SAR 13,450 million in 2019, a growth of 4.4%. This is mainly attributed to the growth of data revenues, the growth of Business Unit and wholesale revenues, in addition to the growth and improvement of subscriber base.

The increase in revenues in 2020, resulted a gross profit of SAR 8,152 million versus SAR 7,800 million in 2019, a growth of 4.5%.

Mobily achieved the highest EBITDA in the last 7 years reaching SAR 5,350 million in 2020 compared to SAR 4,947 million in 2019, or an increase of 8.2%. The EBITDA increase is attributed to the company’s efficiency in managing its operations and the growth of revenues. EBITDA margin increased to 38.1% for 2020 compared to 36.8% for 2019.

Reflecting the improvement in EBITDA, 2020 operational profit amounted to SAR 1,367 million compared to an operational profit of SAR 967 million in 2019, an increase of 41.3%.

Financial charges for 2020 dropped to reach SAR 561 million compared to SAR 929 million in 2019 representing a decrease of 39.6% reflecting the company’s efforts to reduce the funding costs by refinancing big portion of its debts at the end of 2019 and the decrease in the interest rate.

Zakat expenses for 2020 amounted to SAR 43 million compared to Zakat expense of SAR 49 million in 2019.

Mobily net debt amounted to SAR 10,602 million at the end of 2020 versus SAR 10,626 million at the end of 2019. Capex in 2020 amounted to SAR 2,792 million compared to SAR 2,760 million in 2019.

Mobily improved its 2020 operational cash flow (EBITDA-CAPEX) to reach SAR 2,558 million compared to SAR 2,187 million in 2019, representing an increase of 17%.