Ericsson has shown strong business momentum in the second quarter (Q2) of 2022, despite a year-on-year (YoY) decline in gross margin. The telecom vendor continues to fulfill customer commitments, strengthen competitive advantage and invest in supply chain resilience as well as research and development (R&D).

Source: Ericsson / Q2 2022 CFO and CEO Presentation

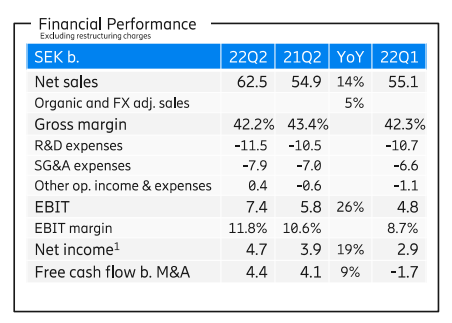

The reported net sales for Q2 2022 had a YoY increase of 14%, surging from SEK 55.1 billion to SEK 62.5 billion. The net income also stepped up by 19% YoY from SEK 2.9 billion to SEK 4.7 billion. Organic sales are at a 5% YoY change, driven by organic growth in four of the five market areas. On the other hand, the gross margin declined to 42.2% caused by lower IPR revenues and higher supply chain costs.

“Fulfilling customer commitments under current challenging conditions comes at a cost, which dilutes gross margin. The increased costs have been largely absorbed through our investments in innovation and continuous improvements,” commented Börje Ekholm, President and CEO.

Reported EBIT amounted to SEK 7.4 billion as a result of higher sales and higher gross income, and the EBIT margin stands at 11.8%. Free cash flow before M&A looks positive at SEK 4.4 billion, showing a 9% YoY growth.

Looking across Ericsson’s business segments, for networks, there are increased investments in Cloud RAN and in Ericsson Silicon (ASICs), while for digital services, there’s double-digit growth in cloud-native 5G core. For managed services, there are continued investments in automation, analytics and AI offerings – supporting 5G and efficiency in service delivery. On the emerging business side, Cradlepoint and iconectiv drove sales growth.

In terms of market area sales, North America’s strong demand for 5G solutions in networks led to a 27% YoY increase in sales, while the Middle East and Africa (MEA) recorded a 17% YoY increase in sales due to software upgrades in Africa. Ericsson has also driven further innovation and empowerment in Saudi Arabia.

Furthermore, the company even adjusted its group structure to both strengthen the execution of its strategy as a leading mobile infrastructure provider and to establish a focused enterprise business.

“Our strategy targets a higher growth trajectory as we aim to grow our core mobile infrastructure business and capitalize on the fast-growing enterprise market. With 5G, the world is experiencing the largest innovation platform to date, where anything that can go wireless, will go wireless. Ericsson is at the epicenter of this powerful trend, and we will continue to invest in technology leadership to ensure we capitalize on this position,” explained Ekholm.

The intended acquisition of Vonage is an important building block, and Ericsson has also announced receiving that clearance, with the merger expected to be closed no later than July 21, 2022. Ericsson and Vonage’s winning combination is approximately worth $6.2 billion.

Related: Ericsson Q1/22: Well-positioned to continue strategic journey