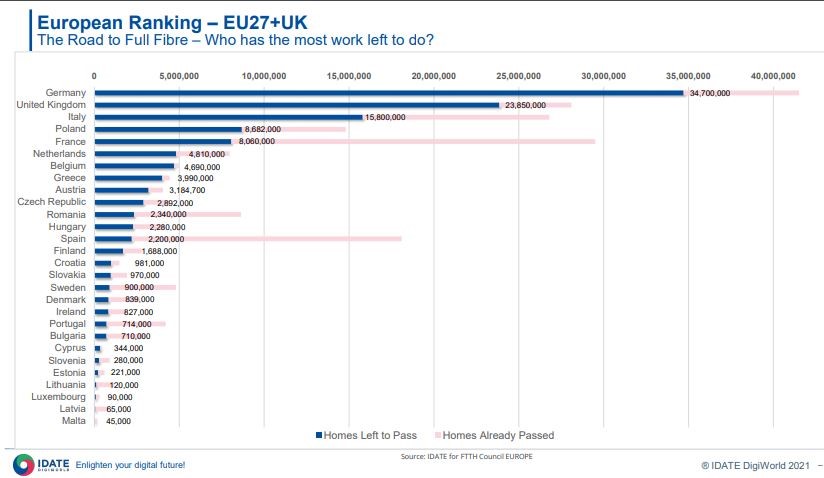

As 5G rollouts continue, investment in fiber optic deployment continues to be a priority as the foundation for 5G wireless networks. However, the FTTH Council Europe and IDATE’s latest FTTH market panorama study over the 12 months until September 2020 has noted that almost 60% of homes in the EU27+UK region are yet to be passed with fiber infrastructure.

The IDATE data shows that Italy, Germany and the UK were respectively the second, third and fourth ranked countries in terms of growth in fibre connections deployed during the year to September 2020. Italy and Germany added 2.8 million and 2.7 million lines respectively, while the UK lagged behind with 1.7 million.

The report points out that many countries with dominant legacy infrastructure are increasingly migrating from copper and cable-based networks to fiber and in some cases adopting complete copper switch-off.

As per the chart, Germany has almost 35 million premises still without access to fiber connection as of September. However, Deutsche Telekom, which posted a net revenue increase by 32.3 percent to 26.4 billion euros in the first quarter of 2021, coincided with a new set of market statistics compiled by Germany’s VATM and Dialog Consult, who predict that by mid-2021 Germany will have 6 million FTTH/B lines by mid-year, 3.7 million of which will be provided by altnets and 2.3 million by the incumbent.

According to the FTTH Council/IDATE, British Telecom (BT) stands at just below 24 million homes. The UK incumbent has announced plans to accelerate its fiber rollout target to 25 million homes by 2026, up from its previous target of 20 million. To achieve that, Openreach, a wholly owned subsidiary of BT Group, will double its current rollout rate to 4 million homes passed per year.

In Italy, aggressive fiber rollout announcements are coming from both TIM, currently creating independent fibre wholesaler FiberCop, and the state-backed Open Fiber venture whose ownership has just been resolved.

The biggest leap in FTTH/B lines installed came from France, where it grew by 4.6 million to 21.4 million, making the country the largest in fiber volume terms in the EU27+UK. Spain ranks second, followed by Italy and Germany; the UK comes in seventh.

Fiber uptake is growing in Europe, but still fewer than half of homes passed have subscribed to full fibre. In the EU27+UK take-up was at 46.9% in September, an increase of 3.6 percentage points over 12 months.

When it came to subscriptions, Spain topped the charts with 11.3 million, and ranks highly in penetration terms at 71%. Penetration remains highest in Iceland, where 79% of homes passed have subscribed to an FTTH/B service, despite a smaller population compared to the major economies. France comes in second in volume terms with 10.3 million connections and a creditable 48% take-up rate

Total of 98.3 million homes were passed with FTTH/B in the EU27+UK as of September, up from 82.3 million in 2019, while the broader EU39, including Russia’s almost 50 million homes passed, grew to 182.5 million from 163.3 million in the same period. Although the numbers are encouraging, the figure should grow with the major incumbents in the region can keep up with their continued commitment.

In line with the UN’s sustainable development goals (SDGs), telcos globally have initiated strategies for connectivity improvements with a focus on access, backhaul and core and management in an attempt to connect the unconnected populations by transforming telecom infrastructure.