By Ken Campbell, Managing Partner in the London office of PMP Strategy and Nicolas Pillon, Associate Partner in the Montreal office of PMP Strategy

Historically, most telecom operators have a hard time ‘sharing their toys.’ While tower sharing has existed for decades and RAN sharing has seen some success, the idea of open access networks on fibre has only really taken shape in the last few years.

France adopted it early, with a regulatory policy that provided pseudo-monopolies in rural areas. The UK, with BT’s Openreach in place, has provided a platform for open access since the UK government’s Digital Communications Review in 2017, forcing the creation of a separate entity. In the UK others have followed, including the Mubadala-backed, alt-net CityFibre and nexfibre (Liberty Global, Telefonica, Infravia JV). In the landscape of UK alternative network providers (altnets), the presence of an open access element is a common thread among many of the 98 players. The intention is to challenge Openreach’s dominance in the market.

The US had been reluctant to pick up the idea as North American broadband markets are characterized by a multitude of vertically-integrated operators. However, various local open access networks (Intrepid, Ubiquity, SiFi, Utopia, Meridiam, Tillman, and Underline) have developed in recent years, and in May of 2023, AT&T and BlackRock came together to announce a joint venture. AT&T’s idea was to build a 1.5 million wholesale open access fibre network in the United States which could leverage the financial strength of BlackRock and the operational/brand strength of AT&T. The JV, called Gigapower, is now taking shape with AT&T as the anchor tenant.

Bob Lagrone, SVP of AT&T Corporate Strategy, summed it up. "We will be the first selling into this, but it's being built as an open access network. We believe that's a better way to drive the utilization of that network up and to reach segments that AT&T might not be able to reach."

While this announcement was big news in the US, PMP expects to see significant progress in open access development in the coming years given its key advantages.

Why Move to Open Access Networks?

- To Drive Penetration: With multiple ISP brands offering services over one network, penetration is boosted. Competitive intensity among ISPs creates an important dynamic.

- To Address Financing Needs: The need to access new sources of financing (project financing/infra-fund equity investment) beyond traditional corporate financing to support the high cost of building these fibre networks.

- To Discourage Infrastructure Based Competition: There is a clear need amongst any company deploying fibre to prevent overbuild risk and defend market share.

- To Support a Converged Offer: There is increasing demand for open access models from MNOs that are eager to capitalize on the convergence thesis. The fixed/mobile convergence strategy enriches MNO’s value proposition by boosting customer retention through churn reduction. This is the case for both T-Mobile in the US and Vodafone in the UK, where they lack their own fibre infrastructure but need a fibre proposition to defend their mobile business through a bundled proposition.

- To Improve the Overall Economics: Open access reinforces overall operator positioning, especially with regards to potential market consolidation. For a fibre infrastructure player, the open access model can be more profitable (and trade at a higher multiple) than the vertically integrated model in the long run.

Although current open access development is still very localized in the US, it will become increasingly important to secure first-mover advantage as the main open access player in regional markets.

Three Main Open-Access Models Exist: Independent Wholesale Platforms, Hybrid Retail/Wholesale Providers and the JV/FibreCo Model

The JV/FibreCo model has widely developed in Europe where tough competition among operators and investment funds’ willingness to finance infrastructure has led operators to open their network (either pushed by the regulator or for economic reasons) and to carve out their networks. Operators needed to finance new infrastructure builds and were facing constraints in funding capacity. European investors were also looking to invest in a new digital asset class and benefited from the low-interest market (at the time). In France in 2018, the Altice FTTH carve-out was one of the first major fiber carve-outs that paved the way for many such developments.

Given the increase in interest rates, debt financing is becoming more challenging, and it is likely that many US and international players will seek to develop JV structures to access equity financing from Infrastructure Funds (IF) to finance the roll-out of their fiber networks.

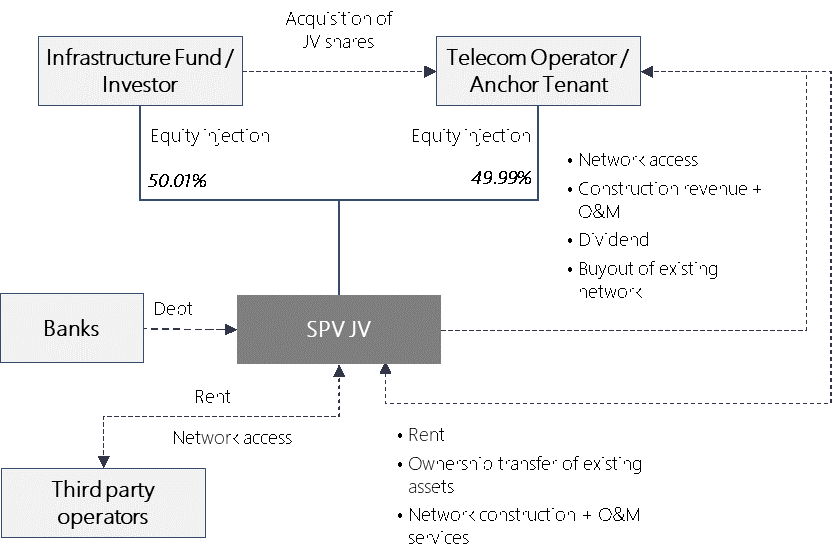

The Standard Characteristics of the Fiber JVs Are the Following:

- Creation of an SPV by an incumbent or a large player (the Telecom Operator/anchor tenant) and the sale of a roughly equal stake of the SPV to an investor to allow deconsolidation

- Call option allows reconsolidation after building period, securing long-term network control

- The operator is an anchor tenant of the JV, buying access to the JV’s network through rental fees or IRUs, usually pledging not to use any other NextGen Network in the area covered by the JV

- The JV-SPV is responsible for network construction, network management and commercialization of the network

- Operations are usually sub-contracted to the operator through ex-ante exclusive sub-contracts, covering network construction, network maintenance, and managed services (IT, payroll, compliance, management, real-estate, etc.)

- Lenders provide additional debt financing to the SPV (Project Financing Model with high gearing ratio and lower interest debt than corporate financing)

In summary, assuming the right conditions, an open access model can de-risk the business and create more business opportunities than an integrated operator.

Standard JV Structure

The ‘age of sharing’ is upon us. As with an airport or a shopping mall, a shared tower or any shared infrastructure, the right mode of investment can provide superior returns and unlock access to lower costs of capital. Assuming the right ISP agreements (or anchor tenancies) are in place, commercial risk is mitigated, and a sustainable business model is created.