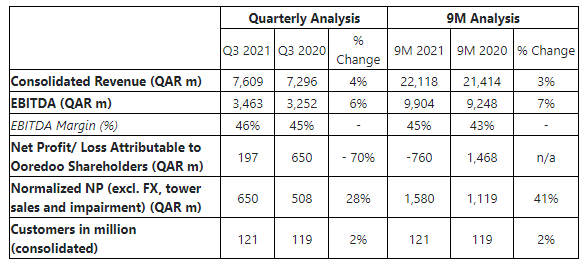

Ooredoo Group released its financial highlights for both quarterly and nine-month analysis of 2021.

To highlight, the consolidated revenue for the nine months stood at QAR 22.1 billion, an increase of 3% compared to the same period last year. This is mainly driven by growth in the markets of Qatar, Indonesia, and Tunisia while the consolidated customer base increased by 2% to exceed 120 million due to strong performances in Indonesia, Oman, Algeria, and Iraq.

Commenting on the results, HE Sheikh Faisal Bin Thani Al Thani, chairman of Ooredoo, said, “We reported solid results for the nine months ended 30 September 2021, driven by the ongoing implementation of our digital strategy and cost optimization program. Revenues increased by 3%, and our EBITDA margin improved to 45%, up from 43% from 9M 2020, despite the challenges presented to us due to COVID-19.

As a leader in the industry, we strive to provide reliable connectivity and innovative products to our customers, which has, in turn, resulted in increased customer confidence in the business and an increase in our customer base by an additional two percent.”

Also commenting on the results, Aziz Aluthman Fakhroo, managing director of Ooredoo, said, “We are pleased to report the ongoing positive trend in the business as market activity improves in some of our core markets. This trend is even stronger excluding the FX impact with revenue growth of 6% and EBITDA growth of 10%. We remain optimistic about the growth of the business and look forward to continuing to deliver long-term value to all our key stakeholders.”

Operational Review (MENA)

- Ooredoo Qatar

Ooredoo Qatar saw growth during the period. Reported revenue was up 3% year-on-year to QAR 5.4 billion, driven by growth in post-paid services, business-to-business revenue, sales of Ooredoo TV, mobile financial services (MFS), and increased sales of devices. EBITDA reached QAR 2.9 billion with EBITDA margin at 54% in line with the previous year. Total customers were 3.1 million.

Ooredoo Qatar’s focus on digitization delivered significant cost savings, with more customers migrating to online self-care and self-service. Major sponsorships announced during the period include title sponsorship of Qatar's first-ever Formula 1 race, which will be officially named the Formula 1 Ooredoo Qatar Grand Prix, and a one-year renewal of the Ooredoo Cup.

- Ooredoo Oman

Ooredoo Oman reported a decrease of 8% in revenue due to lower revenue in consumer mobile prepaid, increased competition in the market, as well as a slowly recovering economy. EBITDA decreased by 12% to QAR 903 million, and EBITDA margin was 52%, down from 54% for the nine-month period in 2020.

5G continues to perform exceedingly well in Oman driven by the continuous roll-out of 5G network with over 580 sites in total as of the end of September.

- Ooredoo Kuwait

The COVID-19 pandemic and a decline in Kuwait’s population continued to put pressure on Ooredoo Kuwait’s performance during 2021. With this, the company reported a slight increase in revenue of QAR 1.9 billion for the nine months. EBITDA increased 16%, supporting an improved EBITDA margin of 30%, up from 26% compared to the same period last year.

Ooredoo Kuwait won the “fastest mobile network in Kuwait” in the Speedtest Awards 2021.

- Asiacell – Iraq

Asiacell reported revenue of QAR 2.8 billion during 9M 2021. In local currency terms, the revenue was up 12% and EBITDA increased by 16% supporting an EBITDA margin of 46% driven by ongoing cost optimization initiatives.

During the quarter, Asiacell focused heavily on improving the customer experience by extending its 4G coverage and optimizing the network, resulting in Asiacell’s position as the number one mobile data network provider in Iraq. Furthermore, the company increased its LTE-enabled sites in the network with a significantly improved 4G data speed resulting in customers shifting from 3G to 4G during the period.

- Ooredoo Algeria

Ooredoo Algeria’s EBITDA increased by 6% for the nine months. The company’s focus on efficiency and cost optimization supported a healthy EBITDA margin of 36%. While revenues stood flat at QAR 1.7 billion, in local currency terms revenue increased by 8%.

Ooredoo Algeria’s “Yooz” continued to be a priority as the company rolled out the new, optimized version of the app, reinforcing Ooredoo Algeria’s position in the market and boosting growth across direct and indirect channels. Yooz is a digital prepaid offer targeting Algerian youth to help them personalize their own data plans virtually and access exclusive digital content. Customer number increased by 3% to reach 12.7 million.

- Ooredoo Tunisia

Ooredoo Tunisia delivered robust results with revenue of QAR 1.2 billion for the nine months ended 30 September 2021, an increase of 8% compared to the same period last year.

This operating branch changed the reporting methodology of its prepaid customer base from the original life-cycle definition to the 90 days network activity definition to align with a common methodology across mobile operators within the country. Ooredoo Tunisia’s customer base now stands at 7.2 million.