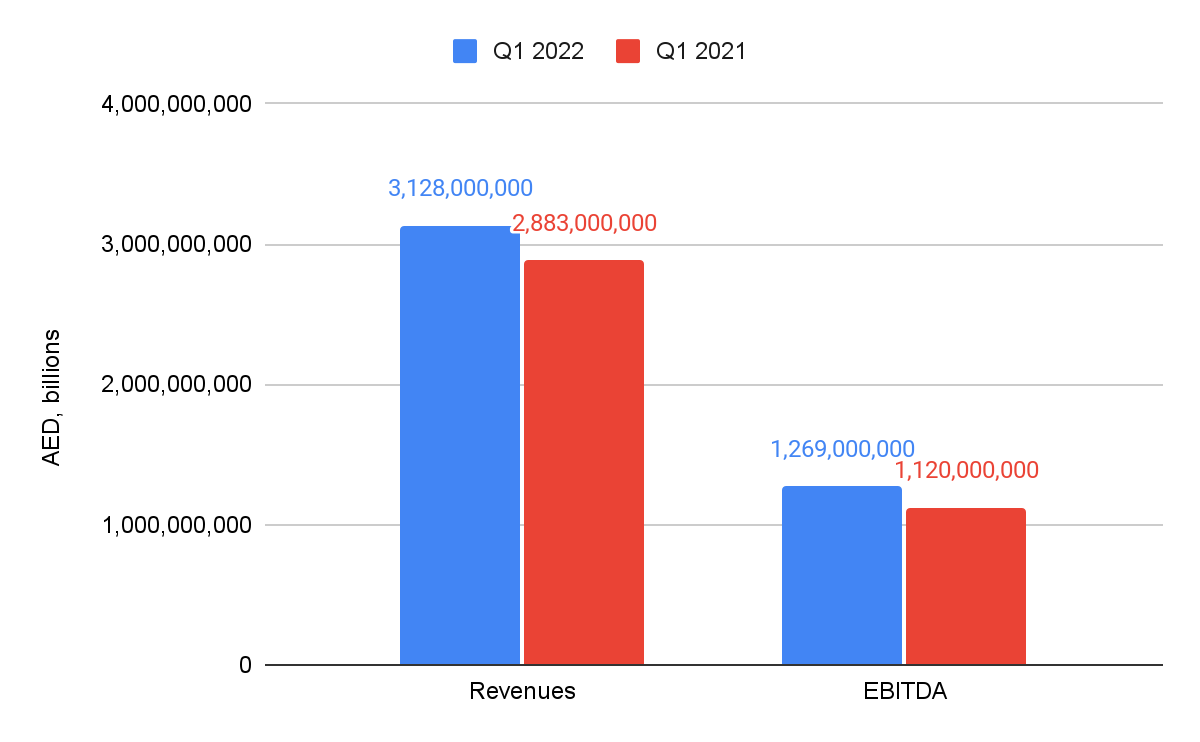

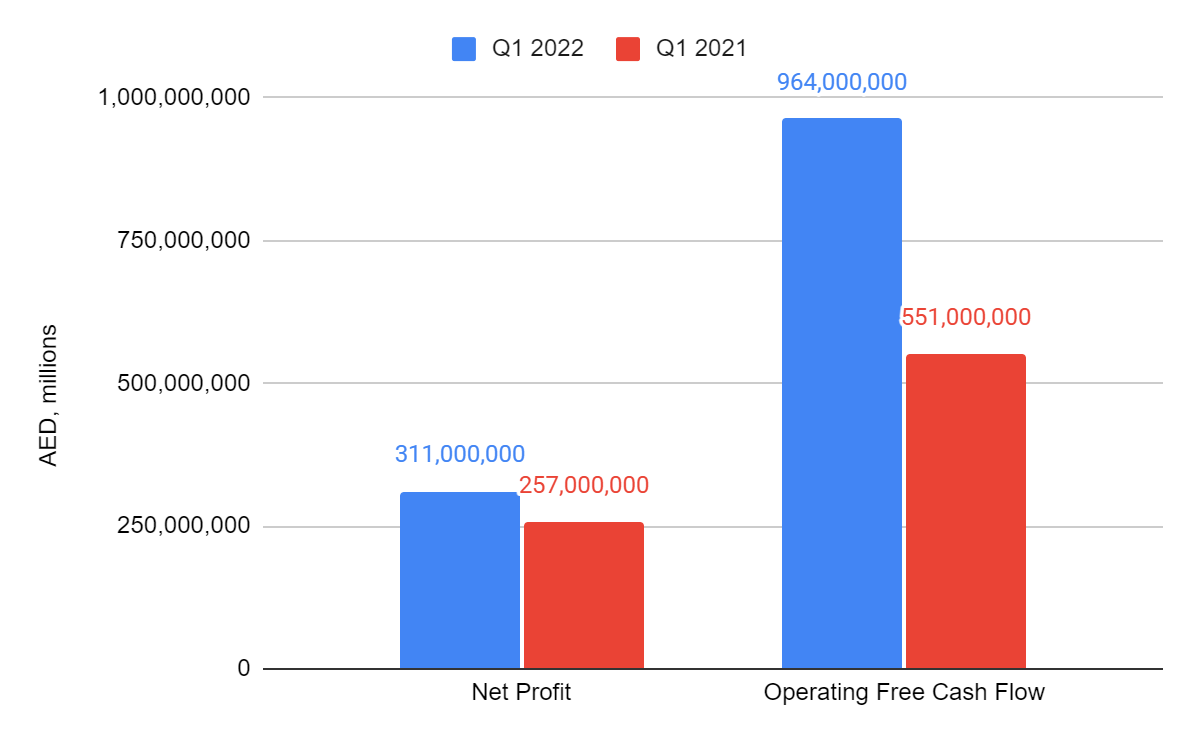

Emirates Integrated Telecommunications Company PJSC, EITC, also known as du, announced its financial results for the first quarter of 2022. Revenues grew by 8.5% to AED 3.1 billion on sustained demand for broadband and mobile services while net profit jumped 21% to AED 311 million.

Commenting on the Q1 2022 results, Fahad Al Hassawi, CEO said, “Our Q1’22 results confirm our recovery trajectory is on a sustainable path. The COVID-19 impact is phasing out. We continued to experience increased mobility and a general improvement in the economic environment. We also continued our efforts to deploy our innovative portfolio of products and services and to implement the transformation of the Company. Our considerable infrastructure investment allows us to continue innovating and improve customer experience. More importantly, it sets the foundations for continued strong performance.”

In terms of operations, du ended Q1 2022 with 7.5 million subscribers across the postpaid and prepaid segments—a 10.4% growth in mobile customers. Prepaid customers were attracted by targeted offers, brisk tourism activity, and continued improvement in the economic environment. For consumer broadband offering, there was a 76.7% YoY increase, embracing 439,000 broadband customers by the end of the first quarter.

*Figures derived from EITC Q1 2022 financial summary

Reported net revenues grew 8.5%, from AED 2.3 billion to AED 3.1 billion. To break it down, mobile service revenues continued their recovery, increasing by 6.9% to AED 1.4 billion while handset sales generated AED 216 million in revenues. Moreover, fixed services revenues jumped 22.8% to AED 815 million on sustained demand from consumer and enterprise customers.

Mainly driven by higher service revenues, EBITDA also increased by 13.3% YoY from AED 1.1 billion to AED 1.3 billion. Given mobile and fixed services’ higher profitability, EBITDA margins have expanded by 170bp to 40.6%.

*Figures derived from EITC Q1 2022 financial summary

Additionally, the net profit of du jumped 21% to AED 311 million from the previous years’ AED 257 million and the operating free cash flow also significantly increased by 75% to AED 964 million from the previous year’s AED 551 million. The latter is the combined result of an improving EBITDA and lower CAPEX, where the operator’s CAPEX profile is said to be normalizing, following two consecutive years of high capital intensity.

“...This quarter’s performance validates our strategy. My team is focused on growth. We are committed to re-invigorating our core mobile and fixed operations while pursuing modernization of our infrastructure. We will continue to work to maintain this positive commercial momentum throughout 2022,” Al Hassawi concluded.