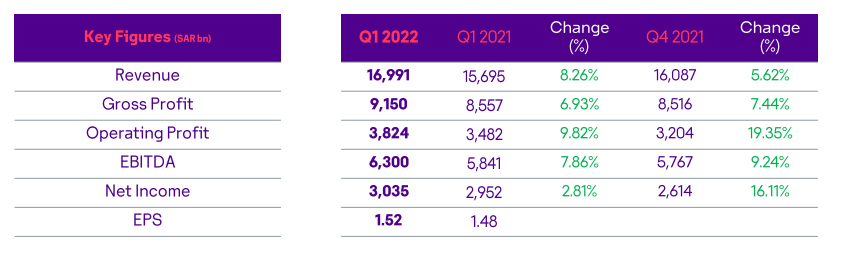

Saudi telecom provider, stc, reported a net profit after Zakat and tax of SAR 3.035 billion for the first quarter of 2022, up 3% from SAR 2.952 billion in the year-ago period.

The increase in net profit by SR 83m in the first quarter as compared to the comparable quarter last year was mainly attributed to the increase in revenues by SR 1,296m, which was offset by the increase in cost of revenues by SR 703m, which led to an increase in gross profit by SR 593m. The Zakat and income tax decreased by SR 59m.

Source: investor relations department

Operating expenses increased by SR 251m, mainly due to the increase in both depreciation and amortization expenses by SR 116m and general and administration expenses by SR 115m.

Total other expenses increased by SR 279m, mainly due to the booking of net share in results and impairment of investments in associates and joint ventures by SR (229m) compared to SR 22m.

Earnings before interest, taxes, zakat, depreciation and amortization (EBITDA) for the first quarter amounted to SR 6,300m compared to SR 5,841m for the same quarter last year, with an increase of 7.86%.

The total number of Treasury shares related to the Employees Stock Incentives Plan stood at 2,850,655 shares at the end of the first quarter 2022 and those shares are not entitled for any dividends distribution. As a result, basic earnings per share (EPS) was calculated based on the weighted average number of ordinary shares in a total of 1,997,149 shares (in thousand) for the first quarter.

Furthermore, the consumer business unit registered a topline growth of 5.9%, supported by the growth in FTTH subscribers by 4.4%, FWA subscribers by 8.3% and working lines by 4.6%. The Wholesale business unit also contributed positively to the company's performance as it registered 7.8% revenue growth, supported by a 20.6% growth in its international revenues, according to the company statement.