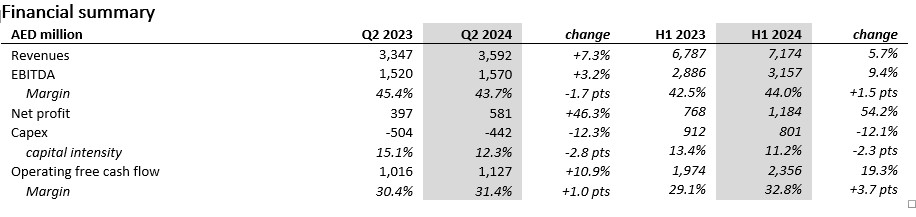

Emirates Integrated Telecommunications Company P.J.S.C, commercially rebranded as du, has reported a 54.2% net profit spike in the first half of 2024 (H1 2024), bringing its total net profit to AED 1.184 billion, compared to AED 768 in H1 2023. Meanwhile, the company's revenue grew 5.7%, reaching AED 7.174 billion, compared to AED 6.787 billion in H1 2023.

The company’s Q2 2024 net profit reached AED 581 million, reflecting a 46.3% increase year-over-year (YoY). Q2 revenues increased by 7.3% to AED 3.592 billion, buoyed by strong product offerings. Top line growth was evident with an EBITDA increase of 3.2% to AED 1.570 billion. CapEx decreased by 12.3% YoY, while operating Free Cash Flow (FCF) was AED 1.127 billion, reflecting a 10.9% increase year-over-year.

On the basis of these results, the Board of Directors approved the distribution of an interim cash dividend of AED 0.20 per share, resulting in a 53.8 % increase YoY.

2023 Q4 Results: EITC (du) Q4 Net Profit Soars 36.8% to AED 1.67 Billion

Operating Highlights

du’s mobile customer base grew 2.9% YoY to 8.2 million subscribers, while tapering over the quarter, reflecting the typical seasonality impact. Postpaid customer base grew by 11.3% YoY to 1.7 million subscribers, attributable to innovative enterprise connectivity solutions and the continued success of consumer product launches such as the “du Smart Car”. Prepaid customer base grew by 0.9% to 6.5 million customers with voice and data growth offset by a normalization of the tourist influx.

Fixed customer base rose by a strong 12.7% YoY to 630,000 subscribers, with net-additions of 15,000 subscribers over the quarter. Home wireless plans continue to be the main growth driver, boosted by new offerings such as the launch of home wireless gaming, while enterprise connectivity also performed strongly during the quarter.

Telecom Review Exclusive Coverage: MWC24: du Commits to Building UAE as 5G-Advanced Country

Commenting on the results, Malek Al Malek, Chairman of TECOM Group and Group CEO of Dubai Holding Asset Management, said, “The first half of 2024 saw EITC deliver another record set of results. The management remained focused on strategy execution, delivering profitable growth in our core business and beyond and creating value to our shareholders. The company remained at the forefront of technological innovation to offer the best experience to our customers in areas including fintech and AI.

“The company’s strategy to deliver unmatched experiences to customers has resulted in the du brand now being the third-strongest in the UAE. The country’s macro-economic environment was very supportive to our activity, and we remain well positioned to support the UAE government digital strategy, as demonstrated by the plan to launch hyperscale cloud and sovereign AI services for the Government.

“Reflecting our dedication to excellence in governance, we made strategic additions to our Board of Directors by welcoming four new members with valuable experience and perspectives. In light of our sustained strong performance and healthy balance sheet, I am pleased to announce that the Board of Directors approved the distribution of an interim cash dividend of AED 0.20 per share, representing an increase of 53.8% compared to interim dividends of 2023. This reflects the Board’s confidence in the Company’s ongoing success and outlook and our commitment to delivering value to our shareholders.”

Telecom Review Exclusive Interview: du: Pioneering Future Tech and Shaping Policies

Meanwhile, Fahad Al Hassawi, du CEO, said, “Our unwavering commitment to excellence, our focused strategy and efficient resource management have enabled us to deliver another strong operational and financial performance in the second quarter of the year. We have grown our subscriber base, revenues, profitability and cash generation, solidifying the stellar start we made this year.

“Our commercial momentum led to a strong growth in our service revenues in Q2, buoyed by significant large enterprise deals with a robust pipeline of new projects as well as the launch of new innovative consumer products.

“In fintech, the first full quarter of du Pay has exceeded our expectations, marking a significant milestone in our innovation journey and further expanding our market reach capabilities. Our results for the first half give us full confidence in delivering our upward revised full year financial guidance.

“Going forward we will remain focused on executing our strategy and are committed to investing in our future, enhancing 5G coverage and continuing to transform our IT and network infrastructure, thus, building a solid foundation for long-term growth and creating value for our shareholders.”

Continue Reading:

Jasim Al Awadi Appointed as du’s New Chief ICT Officer

du Equips Digital Innovation Leaders Through Future X Graduate Program

du and DIFC Innovation Hub Join Forces to Empower Entrepreneurs