Telecom Review presents an exclusive Twimbit report detailing insights into the performance of the four leading cloud service providers during the second quarter of 2023. This report is the first in a five-part series — a comprehensive collection of insights and analyses designed to provide a deep understanding of various subjects.

Read more: Cloud Computing for Business: Types, Benefits and Evolution

Read more: Cloud Innovation: Where Does the MEA Region Stand?

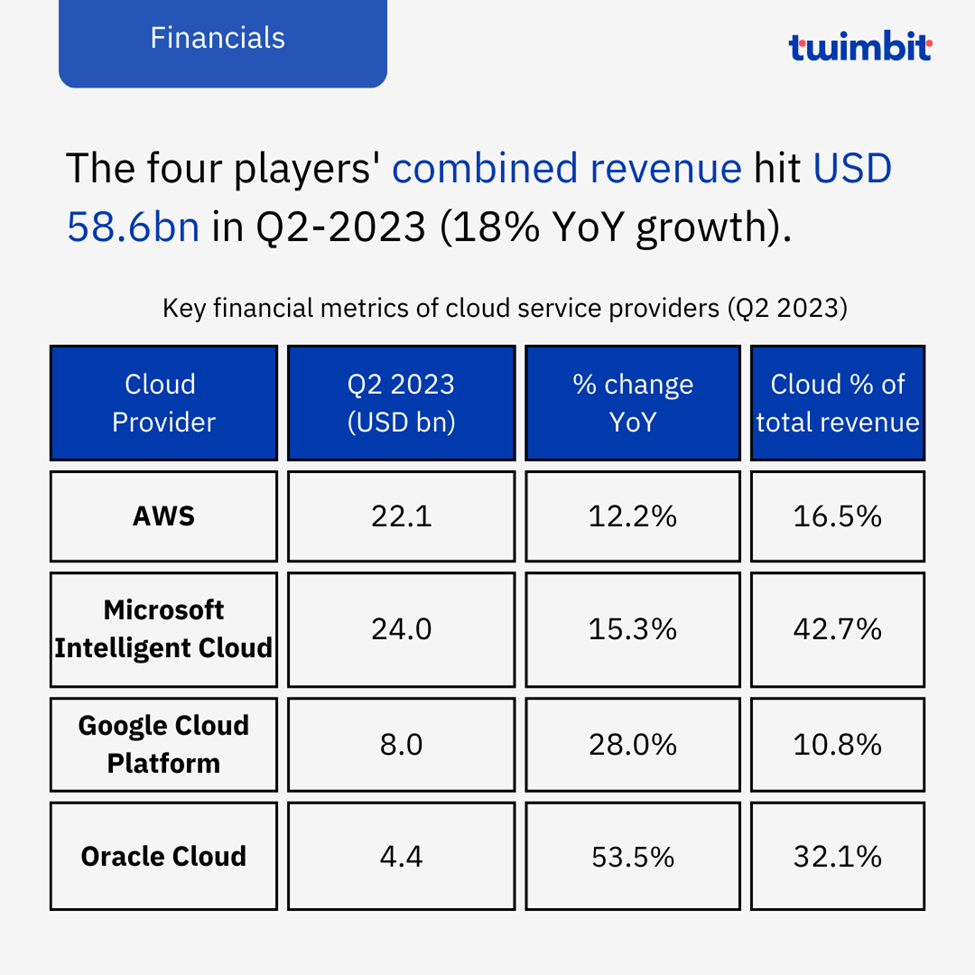

The combined revenue from cloud computing for the industry's top four players — Amazon Web Services (AWS), Microsoft Azure, Google Cloud and Oracle Cloud — reached an impressive US$58.6 billion in Q2 2023. This represents a growth of about 18% compared to the previous year, highlighting the continued success of these technology giants in the ever-changing digital landscape.

Key Financial Metrics of Cloud service providers, (Q2 2022- Q2 2023)

Source: Twimbit Analysis

The significant increase in cloud revenue for each of these companies not only reflects the strong demand for cloud services in the market but also showcases their ability to innovate, adapt and meet the evolving needs of businesses worldwide.

Cloud revenue now makes up an average of 21% of the four players' total earnings, highlighting the growing importance of the cloud in shaping the corporate landscape. The significant increase in cloud revenue reflects the fact that the cloud is not just about storage and processing power but also acts as a foundation for innovation in areas like AI, machine learning and IoT applications. As industries become more digitized, the cloud will play an increasingly integral role in providing operational efficiency and flexibility.

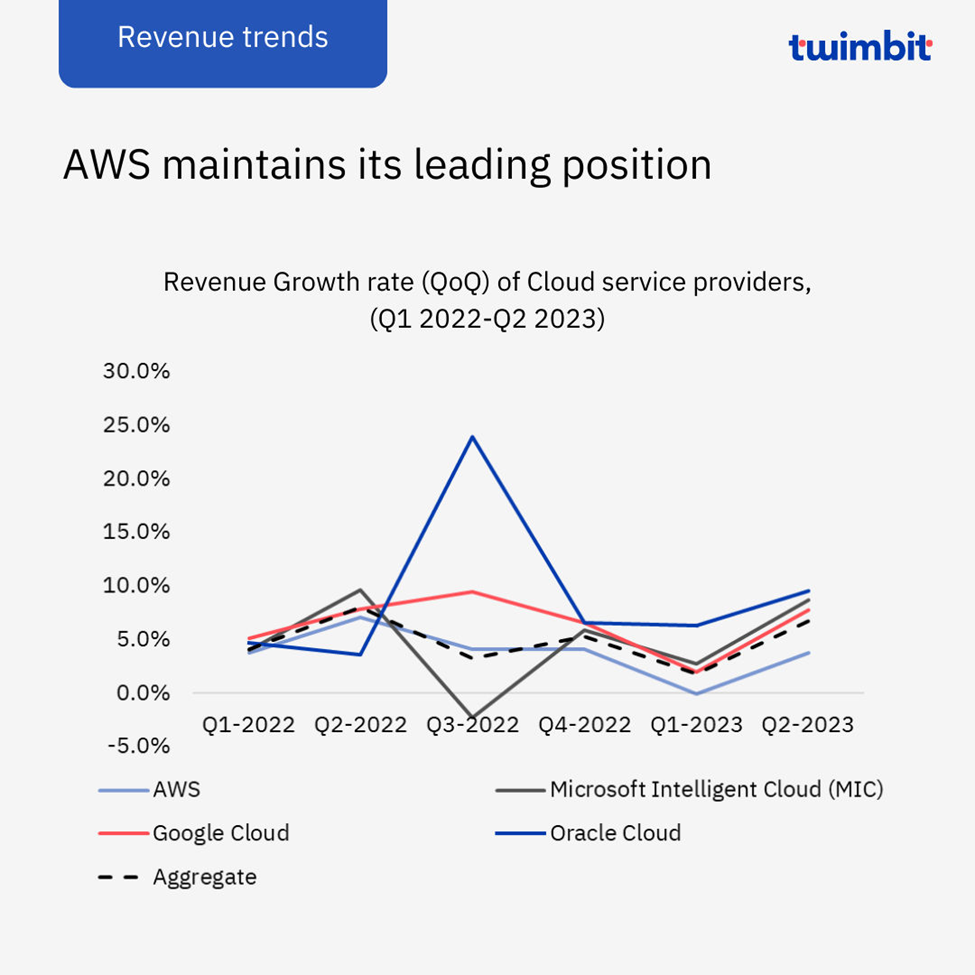

Revenue Growth Rate (QoQ) of Cloud service providers, (Q1 2022-Q2 2023)

Source: Twimbit Analysis

Amazon Web Services, the pioneer of cloud computing, has long held sway over the market. Q2 2023 saw AWS amass a substantial US$22.1 billion in revenue, marking 12.2% year-over-year (YoY) growth compared to Q2 2022. While this growth is undeniably impressive, it also indicates a gradual decline in its once-rocketing trajectory.

The deceleration can be attributed to several factors. Pricing pressure and the push for cost optimization by customers have played a role in tempering AWS's growth. This trend underscores a broader shift in the market, where companies are scrutinizing their cloud expenditures more closely.

Read more: AWS Report: UAE Public Cloud Adoption to Unlock Billions Over Next Decade

Read more: AWS Harnesses Generative AI to Expand New Offerings

Read more: AWS, Ministry of Economy Support SMEs’ Digitization and Growth in UAE

Read more: Bahrain Government Transferred 85% of Data to AWS in 2022

In contrast, Google Cloud has emerged as a significant disruptor. In Q2 2023, it achieved a remarkable revenue of US$8.0 billion, experiencing a marked 28.0% year-over-year growth. Google Cloud's success can be attributed to its robust offerings, particularly the Google Cloud Platform and Google Workspace.

What sets Google Cloud apart is its achievement of the highest operating income in the industry during this quarter, reaching an impressive US$395 million. This figure demonstrates Google Cloud's ability not only to generate revenue but also to effectively manage costs, showcasing its increasing competitiveness in the cloud market.

Read more: Nokia Partners With Google Cloud, AWS, Microsoft for Cloud-Based 5G Solutions

Read more: Google Cloud, Intel Join Forces for Innovations in 5G Networks and Edge Deployments

While AWS and Google Cloud dominate the conversation, other players are also making noteworthy progress. Microsoft Intelligent Cloud (MIC) reported 15.3% year-over-year growth, accumulating US$24 billion in Q2 2023. This performance was driven by the expansion of server products, Azure, and a suite of other cloud services. Oracle Cloud, often overlooked, achieved an impressive year-over-year growth of 53.5%, resulting in US$4.4 billion in Q2 2023.

Read more: Red Hat, Microsoft Deliver a Powerful and Flexible Solution for Automation

This figure represents 32.1% of the overall revenue, highlighting Oracle's significant influence in the global cloud market. As the cloud computing industry matures, stronger growth rates and market dominance are expected. Despite experiencing a slowdown, AWS remains a dominant player due to its extensive infrastructure and established customer base.

Read more: Oracle to Launch New Cloud Regions to Serve Customers Globally

Similarly, Google Cloud's rapid rise in operating income signifies its evolution into a formidable force. These developments emphasize not only the complex nature of the cloud computing landscape but also how the best of the best are facing it head-on. From pricing pressures and cost optimization to innovative service offerings and strategic management, the industry's key players are navigating diverse challenges and opportunities. As cloud technology continues to shape the digital landscape, further transformation and advancement are sure to be a part of its future.

Read more: Cloud Ecosystem: The Path of Moving and Transforming